Primary Non Contributory Endorsement Iso 9001

What is the difference between primary noncontributory vs waiver of subrogation? When a business gets a request for a certificate of insurance, sometimes these endorsements are required. Learn what these insurance terms mean and why they can increase insurance costs. Primary Noncontributory vs Waiver Of SubrogationWhen businesses receive their insurance contracts, it is essential that they read through and understand everything. Battlefield 1942 mods download. However, these certificate of liability requests ( 25) and insurance policies can seem like they're written in a different language than English, which is why you are more likely to send it to your insurance broker so that they can make sure it's all right and give you the details in laments terms.You may have wondered what some of the words on that request mean and why you may have to pay more, sometimes hundreds or even thousands more when the certificate request goes to your broker. Understanding two of the most common requests, primary noncontributory vs waiver of subrogation wording can help you.

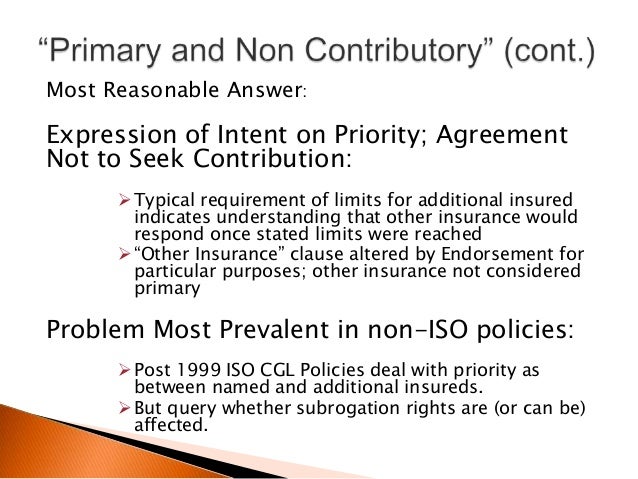

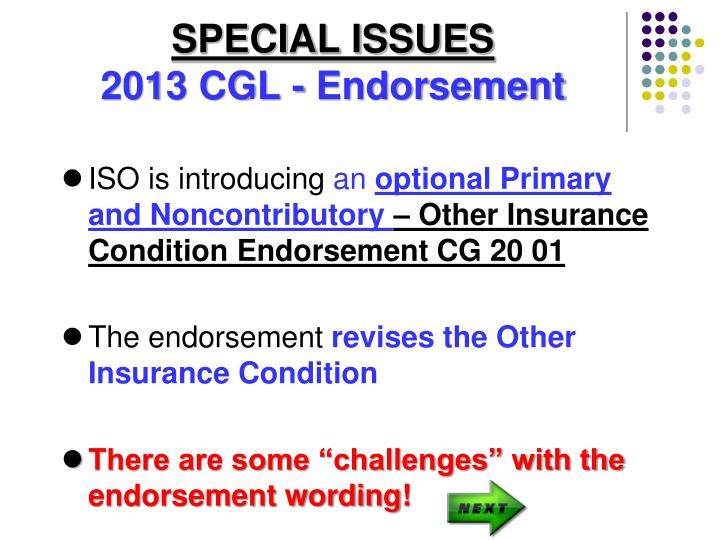

Defining The TermsEven though there are two separate phrases here, there are three definitions at work. Combined, primary noncontributory vs waiver of subrogation can really take a toll on your insurance coverage, but most people don't even know what they mean. Primary & NoncontributoryPrimary & noncontributory is a phrase that's usually together and refers to liability insurance, such as commercial general liability, worker's compensation, auto liability, and others. The primary part means that the policy with which the word applies is the first policy to pay during a claim. The noncontributory part of the phrase means that the policy with which the word applies is the only policy that will pay the claim. This insurance policy doesn't have other policies tied to it to contribute payments to the claim.Waiver Of SubrogationA waiver of subrogation can also be a tricky phrase to understand. First, you must learn what subrogation means.

It is the right of one person/party to substitute another. In the insurance world, subrogation allows the insurance company to sue third parties for relief so that they can recoup full or partial payment made on your claim. A waiver of subrogation means that the insurance company does not have the ability to do this during any part of the claims process. How Primary Noncontributory vs Waiver Of Subrogation Affect Your PolicyBoth options can extend your policy coverage to other people, which keeps your insurance company from recovering any funds from third parties, which could affect your bottom line if a claim is ever opened against you.For example, if you are a and are hired to repair a hospital.

You may be asked to provide a waiver of subrogation and primary noncontributory to the hospital. If someone drove over the materials and hit you or one of your employees, your insurance company will have to pay all the damages, such as the building material damages, worker's compensation, and possibly vehicle damage from the at-fault driver.

The hospital's insurance would offer no contributions for injuries and damages because your insurance policy has these two features.In short, primary & noncontributory wording changes the relationship between the hospital and the contractor. The contractor's insurance becomes primary. The waiver of subrogation acts similarly to the primary and noncontributory wording.

You waive the right of your insurance company to try to get partial or full repayment on the claim, which means your insurance company foots the entire bill. In some cases, this can raise your premiums, costing you more money. Primary Noncontributory vs Waiver Of Subrogation - The Bottom LineWe hope this article on primary noncontributory vs waiver of subrogation has been informative. If you are worried that this could happen to you, it is best to talk to your insurance broker before taking any work or signing any contracts. You may also need to employ a contract attorney before signing anything.

Primary Non Contributory Endorsement Iso 9001 Format

You should review all the agreement terms and what work must be done. Along with such, you may want to include either or both of these endorsements for work that will be done to your property or business, as it can benefit you, as well.For example, if you hire someone to make repairs and your insurance policy has a waiver of subrogation or primary/noncontributory emphasis, your insurance may not be responsible if someone gets hurt on the job. Their insurance will cover everything and won't be able to sue your insurance. Therefore, depending on your situation, it could be in your best interest to have such wording in the policy.

Primary And Non Contributory Endorsement Pdf Gl

However, you may want to talk to a qualified and experienced insurance broker or attorney before making a final decision.

News

- Download Sissy Training Programs

- Chubb Secure 8000 Installer Manual Vista

- Bravo Two Zero A Question Of Betrayal

- Mines Of Moria Rulebook Pdf To Excel

- Discrete Mathematics For Computing Rod Hagerty Pdf Merge

- Rascal Flatts Greatest Hits Volume 1 Rarest

- Sap Businessobjects Web Intelligence The Comprehensive Guide 2nd Edition Pdf

- Free Hallmark Card Studio 2010 Deluxe Programs

- Download Spy Net 3 1 Cracked Me Up

- Download Buku Fotografi Bahasa Indonesia Ke

- Windows Vista Ultimate Super Compressed 80mb Only